- Home

- Personal Banking >

- Credit Cards >

- Loans >

- Mortgages >

- Small Business >

- Investing & Retirement >

- Wealth Management >

- Corporate & Commercial >

- Resource Center >

MAIN MENU

- < View Main Menu

- Checking Accounts >

- Savings Accounts >

- Premier Banking Program >

- Digital Banking >

- Digital Payments >

- SunTrust Deals >

- More Services >

Personal Banking MENU

- < View Main Menu

- Cash Rewards Credit Card

- Travel Rewards Credit Card

- Prime Rewards Credit Card

- Secured Credit Card

- Features and Rewards >

- Business Credit Cards

Credit Cards MENU

- < View Main Menu

- Home Improvement >

- Home Equity Line of Credit >

- Auto Loans >

- Other Loans >

- Student Loan Information >

- Debt Consolidation >

- Recreational Loans >

Loans MENU

- < View Main Menu

- Buying a Home >

- Refinancing

- Current Rates

- Mortgage Calculators

- SmartGUIDE® Mortgage Application

- Business Partners >

- Existing Clients >

- Mortgage Customer Service >

- ConfidenceNow Pre-Approval℠

Mortgages MENU

- < View Main Menu

- Banking >

- Business Credit Cards >

- Loans >

- Merchant Services >

- Payroll >

- Cash Management >

- Your Future >

- Best Practices >

Small Business MENU

- < View Main Menu

- Financial Planning & Advice >

- How to Invest >

- Retirement Planning >

- Investment Solutions >

- Find a Financial Advisor

Investing & Retirement MENU

- < View Main Menu

- Your Priorities >

- Our Approach >

- Solutions and Tools >

- Specialty Groups >

- Find an Advisor

Wealth Management MENU

- < View Main Menu

- SunTrust Advantage >

- Products & Services >

- Industry Expertise >

- Access your Treasury Account

Corporate & Commercial MENU

- < View Main Menu

- Personal Finances Resource Center >

- Homeownership Resource Center >

- Investing & Retirement Resource Center >

- Wealth Management Resource Center >

- Small Business Resource Center >

- Commercial & Corporate Resource Center >

- Foundations & Endowments Resource Center >

Resource Center MENU

- < View Personal Banking Menu

- Essential Checking >

- Advantage Checking >

- Features and Benefits >

- Essential Checking for Students

Checking Accounts MENU

- < View Personal Banking Menu

- Essential Savings

- Advantage Money Market Savings

- Youth Advantage Savings

- Personal Certificates of Deposit (CDs)

Savings Accounts MENU

- < View Personal Banking Menu

- Your Premier Program Team

- Benefits & Rewards

Premier Banking Program MENU

- < View Personal Banking Menu

- Online Banking >

- Mobile Banking >

- ATM

Digital Banking MENU

- < View Personal Banking Menu

- How to Use Apple Pay

- How to Use Samsung Pay

- How to Use Fitbit Pay

- How to Use Garmin Pay

- How to Checkout Online with Click to Pay

Digital Payments MENU

- < View Personal Banking Menu

- Frequently Asked Questions

- Terms & Conditions

SunTrust Deals MENU

- < View Personal Banking Menu

- Check Cashing Services

- Wire Transfer Services

- 24-Hour Automated Telephone Banking

More Services MENU

- < View Credit Cards Menu

Cash Rewards Credit Card MENU

- < View Credit Cards Menu

Travel Rewards Credit Card MENU

- < View Credit Cards Menu

Prime Rewards Credit Card MENU

- < View Credit Cards Menu

Secured Credit Card MENU

- < View Credit Cards Menu

- EMV Chip Card Technology

Features and Rewards MENU

- < View Credit Cards Menu

Business Credit Cards MENU

- < View Loans Menu

- Home Equity Line of Credit

- Unsecured Home Improvement Loans

- Personal Lines of Credit

Home Improvement MENU

- < View Loans Menu

- Check Current Rates

- What is a HELOC?

- HELOC FAQs

- Check Application Status

- Retrieve Saved Application

- Draw Period Ending

- Need Payment Assistance

Home Equity Line of Credit MENU

- < View Loans Menu

- New Auto Loan

- Used Auto Loans

- Auto Refinancing

- Classic Car Loan

- Auto Lease Buyout

Auto Loans MENU

- < View Loans Menu

- Unsecured LightStream Loan

- Home Equity Line of Credit

- Personal Lines of Credit >

- CD Secured Loan

- Physician Loans and Lines of Credit >

- Business Loans

Other Loans MENU

- < View Loans Menu

- Repayment and Loan Servicing

- Avoiding Default

- Cosigner Release

Student Loan Information MENU

- < View Loans Menu

- Equity Line of Credit

- LightStream Debt Consolidation Loan

- Personal Lines of Credit

- Personal Credit Cards

Debt Consolidation MENU

- < View Loans Menu

- Boat

- RV

- Motorcycle

Recreational Loans MENU

- < View Mortgages Menu

- Types of Mortgage Loans >

- First Time Home Buyer

- Homebuyer Privileges

Buying a Home MENU

- < View Mortgages Menu

Refinancing MENU

- < View Mortgages Menu

Current Rates MENU

- < View Mortgages Menu

Mortgage Calculators MENU

- < View Mortgages Menu

SmartGUIDE® Mortgage Application MENU

- < View Mortgages Menu

- Builders

- Correspondent Lending >

- Real Estate Professionals

Business Partners MENU

- < View Mortgages Menu

- Payment Options

- Forms

- Mortgage Assistance Program

Existing Clients MENU

- < View Mortgages Menu

- FAQs

Mortgage Customer Service MENU

- < View Mortgages Menu

ConfidenceNow Pre-Approval℠ MENU

- < View Small Business Menu

- Compare Business Checking >

- Business CDs

- Business Money Market Account

- Business Online and Mobile >

- SunView Treasury Manager

- Online Bill Pay

- Online Courier

Banking MENU

- < View Small Business Menu

- Business Rewards Credit Card

- Business Non Profit Credit Card

- Business Credit Card Servicing

Business Credit Cards MENU

- < View Small Business Menu

- Business Term Loans

- SBA Loans

- Equipment Financing

- Commercial Mortgage

- Lines of Credit

- SBA Working Capital Loan

Loans MENU

- < View Small Business Menu

- Widespread Payment Acceptance

- Loyalty Programs Small Business

- Transaction Security

Merchant Services MENU

- < View Small Business Menu

- Direct Deposit Services

- ACH Services

- Online 401k >

Payroll MENU

- < View Small Business Menu

- Wire Transfer

- Deposit Checks Online

- ACH Banking

- Online Bill Presentment & Payment

- Cash Vault Services

- Lockbox Services

- Business Sweep

- Fraud Protection >

- Letters of Credit and Trade Services >

Cash Management MENU

- < View Small Business Menu

- Your Retirement

- Personal Wealth Management

Your Future MENU

- < View Small Business Menu

- Starting Your Small Business

- Controlling Cash Flow

- Increasing Profitability

- Growing Your Business

- Protecting Your Assets

- Planning for Business Transition

- Guides and Resources

- Videos and Webinars

Best Practices MENU

- < View Investing & Retirement Menu

- Financial Planning Process

- SunTrust SummitView®

- Choose an Advisory Service Level

- Our Investment Philosophy

Financial Planning & Advice MENU

- < View Investing & Retirement Menu

- Quick Guide to Investing >

How to Invest MENU

- < View Investing & Retirement Menu

- Quick Guide to Retirement >

Retirement Planning MENU

- < View Investing & Retirement Menu

- Types of Investments

- Stocks

- Bonds

- Mutual Funds

- Global Investing

- Annuities

- ETFs

- Types of IRAs >

- Taxable Brokerage Accounts

- BrightFolio

Investment Solutions MENU

- < View Investing & Retirement Menu

Find a Financial Advisor MENU

- < View Wealth Management Menu

- Family

- Retirement

- Wealth Transfer & Inheritance

- Work & Career

- Health & Wellness

- Women and Investing

- Considerations for LGBT

- Philanthropy

Your Priorities MENU

- < View Wealth Management Menu

- Our Clients >

- Goals-Based Planning >

- About Us >

Our Approach MENU

- < View Wealth Management Menu

- Investment Solutions >

- Banking Solutions >

- Retirement Solutions

- Insurance Solutions >

- Trust and Estate Solutions >

- Truist PortfolioView

Solutions and Tools MENU

- < View Wealth Management Menu

- Sports and Entertainment

- Medical

- Legal

- International Wealth

- Family Office

Specialty Groups MENU

- < View Wealth Management Menu

Find an Advisor MENU

- < View Corporate & Commercial Menu

- Leadership

- How We Work

- National Footprint

SunTrust Advantage MENU

- < View Corporate & Commercial Menu

- Credit and Financing >

- Treasury Management >

- Business Transition >

- Capital Markets

- Commercial Real Estate Banking

- International Solutions >

- Investment Banking Services

- Escrow & Reinsurance >

- Risk Management >

Products & Services MENU

- < View Corporate & Commercial Menu

- Investment Banking Coverage

- Senior Care

- Associations and Charities (NFP)

- Auto Dealers >

- Commercial Real Estate

- Education

- Food and Agribusiness

- Foundations and Endowments >

- Governments and Municipalities

- Healthcare >

- Logistics & Supply Chain

- Multi-Unit Retail >

Industry Expertise MENU

- < View Corporate & Commercial Menu

Access your Treasury Account MENU

- < View Resource Center Menu

- Plan & Budget >

- Saving >

- Debt & Credit >

- Family & Friends >

- College >

- Work Life

- Health & Wellness

- Travel

- Holiday

Personal Finances Resource Center MENU

- < View Resource Center Menu

- First Time Home Buyer

- Buying and Selling

- Renovating and Maintaining

- Correspondent Lending

- Realtor Builder Insights

- Homeownership Calculators

Homeownership Resource Center MENU

- < View Resource Center Menu

- Investing >

- Retirement >

- Protect Your Family >

- Charitable Giving

Investing & Retirement Resource Center MENU

- < View Resource Center Menu

- Market Insights >

- Financial Planning

- Estate Planning

- Health and Wellness

- Life Priorities

- Sports and Entertainment

- Medical Professionals

- Legal Professionals

Wealth Management Resource Center MENU

- < View Resource Center Menu

- Start Your Business

- Control Cash Flow

- Increase Profitability

- Grow Your Business

- Protect Your Assets

- Transition Your Business

Small Business Resource Center MENU

- < View Resource Center Menu

- Cash Flow

- Financing and Capital Markets

- Business Operations >

- Fraud Protection

- Business Transition

- Industry and Local Trends

- Business Resilience

Commercial & Corporate Resource Center MENU

- < View Resource Center Menu

- Investments

- Private Foundations

- Associations

- Planned Giving

- Endowments

- Expert Interviews

- Trustees

Foundations & Endowments Resource Center MENU

California Consumer Privacy Act MENU

Consumer Privacy Rights MENU

Privacy Resources MENU

Online Privacy Practices MENU

promotion MENU

open-small-business-checking-account-feb200 MENU

mortgage-winter-newsletter MENU

Premier Outreach MENU

adv-mma MENU

Cash Rewards Credit Card ITA Short MENU

2018-trends-survey MENU

how-to-grow-small-business-tool MENU

how-to-manage-cash-flow-tool MENU

how-to-increase-small-business-profits-tool MENU

platinum-elite MENU

buy-remodel-home MENU

list-of-microsites MENU

- forbes-image

corporate-commercial-banking MENU

ocd-demo MENU

lockbox-demo MENU

mortgage-loan-refinance MENU

private-wealth-dashboard MENU

custom-choice-student-loan MENU

open-small-business-checking-account MENU

signature-mma-np MENU

prime-rewards-credit-card-ita MENU

Elite Email A MENU

Elite Email B MENU

Elite Email C MENU

Elite Email D MENU

Buying Home During Holidays MENU

travel-rewards-credit-card-ita MENU

Cash Rewards Credit Card ITA MENU

send-money-zelle MENU

florida-state-university-student-checking MENU

credit-card-suntrust-park MENU

veteran-va-home-loan MENU

fha-loan MENU

checking-offer MENU

mortgage-loans MENU

ca-equity-line-of-credit MENU

Balance Transfer MENU

sa-brokerage-upgrade MENU

Digital Mobile Banking MENU

Mortgage First Time Homebuyer MENU

Mortgage Options MENU

avoid-fees MENU

veteran-va-home-loan-refinance MENU

Paymy Bills MENU

Transfer Money Online MENU

Treasury Terms MENU

YMCA Commercial Card MENU

trusteer MENU

paymentstub MENU

sunviewdemo MENU

online-payroll-demo MENU

sales-demo-web MENU

- cookiegen

Online Courier MENU

contact-us MENU

Dealer Services Next Step MENU

mortgage-refinance MENU

mortgage-options-affiliate MENU

- cookiegen

remote-check MENU

- results

Checking Account Best Fit MENU

- funds

- guidelines

- application-info

foundation MENU

medical-mortgage-loans MENU

send-money-with-zelle MENU

send-money-with-zelle-mobile MENU

small-business-t1 MENU

small-business-t7 MENU

- Login

- referencematerials

- releaseinformation

- toolsforsuccess

- quicklinks

- Default

- cookiegen

ESP Express MENU

- Login

- referencematerials

- reports

- forms

- quicklinks

- Default

- Release Information

- cookiegen

ESP Info MENU

- user_manuals >

- Onlineachcontrol >

- otm-tutorial

OTM MENU

- Login

- reference-materials

- other-solutions

- training

- contact-us

- Index

- cookiegen

- token-information

Sunview Info MENU

tabs-small-business MENU

tabs-signature-advantage MENU

home-mortgage-refinance MENU

home-mortgage-loans MENU

esp-express-demo MENU

mortgage-rate-blast MENU

ps-tabs-select-savings MENU

zelle-suntrust-sweepstakes MENU

Travel Rewards Credit Card Test & Learn MENU

my-smms MENU

smms MENU

Home Improvement Project MENU

Home Improvement Funding MENU

College Loans MENU

Private Student Loans MENU

CD MENU

MMA MENU

credit-card-stadium-rewards MENU

Donate United Way MENU

consolidate-debt MENU

cd-offer MENU

mma-3-month MENU

mma-12-month MENU

premier MENU

mma-checking-12-month MENU

mma-checking-3-month MENU

Virginia Hospital Center MENU

mortgage-introduction MENU

mbs-suntrust-rewards-thank-you MENU

Mortgage Roadmap MENU

Mortgage Barriers MENU

SunTrust Park Thank You MENU

mortgage-spring-newsletter-cd MENU

mortgage-planning MENU

mortgage-calculators MENU

travel-rewards-credit-card-tlp MENU

home-improvement MENU

trends-survey MENU

mortgage-loan-options MENU

summer-savings MENU

mortgage-summer-newsletter-cd MENU

summer-savings-rates MENU

mma-tn MENU

mma-1 MENU

how-to-protect-your-assets-tool MENU

amms MENU

your-amms MENU

cash-rewards-credit-card-ita-vidtl MENU

busmma MENU

credit-card-coa-tl MENU

Small Business Assessment MENU

mortgage-fall-newsletter MENU

student-loan-rates MENU

cash-rewards-credit-card-tlhol MENU

Advantage Offer MENU

Mortgage Winter Newsletter CD MENU

SunTrust at Work MENU

Promo Business MMA MENU

Cash Management Evaluator Tool MENU

Small Business Online MENU

Mortgage Spring Newsletter MENU

SunTrust Business Online MENU

Advantage Checking Combo Offer MENU

mma-offer MENU

Mortgage Summer Newsletter MENU

Open Business Banking Checking Account MENU

Open Small Business Checking Account Jan200 MENU

combo MENU

checking-200 MENU

welcome2 MENU

open-small-business-checking-account-mar200 MENU

new-small-business-checking-account MENU

open-small-business-checking-account-apr200 MENU

welcome3 MENU

student-100 MENU

open-small-business-checking-account-jun200 MENU

Delta SkyMiles® Debit Card Promotion MENU

- access

- planning-and-expertise

- rewards

- community

- whats-a-heloc

- spending-in-retirement

- smart-strategies-for-charitable-donations

- simple-strategies-for-protecting-what-you-earned

- principles-of-financial-planning

- meet-your-goals-with-a-financial-plan

- how-to-borrow-for-college

- how-much-home-can-you-afford

- fresh-perspective-on-retirement-income

- differences-between-traditional-and-roth-iras

- college-savings-calculator

- article12

- 5-times-to-consider-refinancing-your-mortgage

- 4-homebuying-myths-debunked

- journey >

SunTrust Premier Banking MENU

- < View Essential Checking Menu

- Fee Schedule

Essential Checking MENU

- < View Advantage Checking Menu

- Fee Schedule

Advantage Checking MENU

- < View Features and Benefits Menu

- Debit Cards

- Check Routing Information

- Direct Deposit

- Order Checks Online

- Foreign Currency

- Overdraft Services

Features and Benefits MENU

- < View Essential Checking for Students Menu

Essential Checking for Students MENU

- < View Essential Savings Menu

Essential Savings MENU

- < View Advantage Money Market Savings Menu

Advantage Money Market Savings MENU

- < View Youth Advantage Savings Menu

Youth Advantage Savings MENU

- < View Personal Certificates of Deposit (CDs) Menu

Personal Certificates of Deposit (CDs) MENU

- < View Your Premier Program Team Menu

Your Premier Program Team MENU

- < View Benefits & Rewards Menu

Benefits & Rewards MENU

- < View Online Banking Menu

- Pay and Transfer Money

- Pay Bills

- eBills

- Paperless Statements

- Browser Requirements

Online Banking MENU

- < View Mobile Banking Menu

- Mobile Check Deposit

- Mobile Apps

- Text Banking

- Mobile Alerts

Mobile Banking MENU

- < View ATM Menu

ATM MENU

- < View How to Use Apple Pay Menu

How to Use Apple Pay MENU

- < View How to Use Samsung Pay Menu

How to Use Samsung Pay MENU

- < View How to Use Fitbit Pay Menu

How to Use Fitbit Pay MENU

- < View How to Use Garmin Pay Menu

How to Use Garmin Pay MENU

- < View How to Checkout Online with Click to Pay Menu

How to Checkout Online with Click to Pay MENU

- < View Frequently Asked Questions Menu

Frequently Asked Questions MENU

- < View Terms & Conditions Menu

Terms & Conditions MENU

- < View Check Cashing Services Menu

Check Cashing Services MENU

- < View Wire Transfer Services Menu

Wire Transfer Services MENU

- < View 24-Hour Automated Telephone Banking Menu

24-Hour Automated Telephone Banking MENU

- < View EMV Chip Card Technology Menu

EMV Chip Card Technology MENU

- < View Home Equity Line of Credit Menu

Home Equity Line of Credit MENU

- < View Unsecured Home Improvement Loans Menu

Unsecured Home Improvement Loans MENU

- < View Personal Lines of Credit Menu

Personal Lines of Credit MENU

- < View Check Current Rates Menu

Check Current Rates MENU

- < View What is a HELOC? Menu

What is a HELOC? MENU

- < View HELOC FAQs Menu

HELOC FAQs MENU

- < View Check Application Status Menu

Check Application Status MENU

- < View Retrieve Saved Application Menu

Retrieve Saved Application MENU

- < View Draw Period Ending Menu

Draw Period Ending MENU

- < View Need Payment Assistance Menu

Need Payment Assistance MENU

- < View New Auto Loan Menu

New Auto Loan MENU

- < View Used Auto Loans Menu

Used Auto Loans MENU

- < View Auto Refinancing Menu

Auto Refinancing MENU

- < View Classic Car Loan Menu

Classic Car Loan MENU

- < View Auto Lease Buyout Menu

Auto Lease Buyout MENU

- < View Unsecured LightStream Loan Menu

Unsecured LightStream Loan MENU

- < View Home Equity Line of Credit Menu

Home Equity Line of Credit MENU

- < View Personal Lines of Credit Menu

- Personal Credit Line Plus

- Select Credit Line

Personal Lines of Credit MENU

- < View CD Secured Loan Menu

CD Secured Loan MENU

- < View Physician Loans and Lines of Credit Menu

- Physician Loan

- Physician Line of Credit

- Physician Loan Terms & Conditions

Physician Loans and Lines of Credit MENU

- < View Business Loans Menu

Business Loans MENU

- < View Repayment and Loan Servicing Menu

Repayment and Loan Servicing MENU

- < View Avoiding Default Menu

Avoiding Default MENU

- < View Cosigner Release Menu

Cosigner Release MENU

- < View Equity Line of Credit Menu

Equity Line of Credit MENU

- < View LightStream Debt Consolidation Loan Menu

LightStream Debt Consolidation Loan MENU

- < View Personal Lines of Credit Menu

Personal Lines of Credit MENU

- < View Personal Credit Cards Menu

Personal Credit Cards MENU

- < View Boat Menu

Boat MENU

- < View RV Menu

RV MENU

- < View Motorcycle Menu

Motorcycle MENU

- < View Types of Mortgage Loans Menu

- Adjustable-Rate Mortgages (ARM)

- High Cost Home Financing

- Doctor Loan Programs

- Federal Housing Administration (FHA) Home Loans

- Fixed Rate Mortgages

- Jumbo Mortgage Loan

- Affordable Financing

- USDA Rural Development Loan

- VA Loans

Types of Mortgage Loans MENU

- < View First Time Home Buyer Menu

First Time Home Buyer MENU

- < View Homebuyer Privileges Menu

Homebuyer Privileges MENU

- < View Builders Menu

Builders MENU

- < View Correspondent Lending Menu

- Non-Delegated Lending

- Many Solutions

Correspondent Lending MENU

- < View Real Estate Professionals Menu

Real Estate Professionals MENU

- < View Payment Options Menu

Payment Options MENU

- < View Forms Menu

Forms MENU

- < View Mortgage Assistance Program Menu

Mortgage Assistance Program MENU

- < View FAQs Menu

FAQs MENU

- < View Compare Business Checking Menu

- Simple Business Checking

- Primary Business Checking

- Business Advantage Plus Checking

- Analyzed Business Checking

- Analyzed Interest Checking

- Business Overdraft Protection

- Business Debit Cards

Compare Business Checking MENU

- < View Business CDs Menu

Business CDs MENU

- < View Business Money Market Account Menu

Business Money Market Account MENU

- < View Business Online and Mobile Menu

- Business Online and Mobile Fee Schedule

- Business Online and Mobile Service Agreement

Business Online and Mobile MENU

- < View SunView Treasury Manager Menu

SunView Treasury Manager MENU

- < View Online Bill Pay Menu

Online Bill Pay MENU

- < View Online Courier Menu

Online Courier MENU

- < View Business Rewards Credit Card Menu

Business Rewards Credit Card MENU

- < View Business Non Profit Credit Card Menu

Business Non Profit Credit Card MENU

- < View Business Credit Card Servicing Menu

Business Credit Card Servicing MENU

- < View Business Term Loans Menu

Business Term Loans MENU

- < View SBA Loans Menu

SBA Loans MENU

- < View Equipment Financing Menu

Equipment Financing MENU

- < View Commercial Mortgage Menu

Commercial Mortgage MENU

- < View Lines of Credit Menu

Lines of Credit MENU

- < View SBA Working Capital Loan Menu

SBA Working Capital Loan MENU

- < View Widespread Payment Acceptance Menu

Widespread Payment Acceptance MENU

- < View Loyalty Programs Small Business Menu

Loyalty Programs Small Business MENU

- < View Transaction Security Menu

Transaction Security MENU

- < View Direct Deposit Services Menu

Direct Deposit Services MENU

- < View ACH Services Menu

ACH Services MENU

- < View Online 401k Menu

- For Employers

- For Employees

Online 401k MENU

- < View Wire Transfer Menu

Wire Transfer MENU

- < View Deposit Checks Online Menu

Deposit Checks Online MENU

- < View ACH Banking Menu

ACH Banking MENU

- < View Online Bill Presentment & Payment Menu

Online Bill Presentment & Payment MENU

- < View Cash Vault Services Menu

Cash Vault Services MENU

- < View Lockbox Services Menu

Lockbox Services MENU

- < View Business Sweep Menu

Business Sweep MENU

- < View Fraud Protection Menu

- Help

- Online and Mobile Guarantees

- Resources

- Controlled Disbursement Account

- Business Record Keeping

- Trusteer Rapport

Fraud Protection MENU

- < View Letters of Credit and Trade Services Menu

- Online Foreign Exchange

- Global Payment Solutions

- Documentary Collections

- Letters of Credit

Letters of Credit and Trade Services MENU

- < View Your Retirement Menu

Your Retirement MENU

- < View Personal Wealth Management Menu

Personal Wealth Management MENU

- < View Starting Your Small Business Menu

Starting Your Small Business MENU

- < View Controlling Cash Flow Menu

Controlling Cash Flow MENU

- < View Increasing Profitability Menu

Increasing Profitability MENU

- < View Growing Your Business Menu

Growing Your Business MENU

- < View Protecting Your Assets Menu

Protecting Your Assets MENU

- < View Planning for Business Transition Menu

Planning for Business Transition MENU

- < View Guides and Resources Menu

Guides and Resources MENU

- < View Videos and Webinars Menu

Videos and Webinars MENU

- < View Financial Planning Process Menu

Financial Planning Process MENU

- < View SunTrust SummitView® Menu

SunTrust SummitView® MENU

- < View Choose an Advisory Service Level Menu

Choose an Advisory Service Level MENU

- < View Our Investment Philosophy Menu

Our Investment Philosophy MENU

- < View Quick Guide to Investing Menu

- Set Goals

- Determine Investment Risk Tolerance

- How to Choose Investments

- Monitor Progress

Quick Guide to Investing MENU

- < View Quick Guide to Retirement Menu

- Getting Started

- Grow Your Retirement Savings

- Preparing for Retirement

- Living in Retirement

Quick Guide to Retirement MENU

- < View Types of Investments Menu

Types of Investments MENU

- < View Stocks Menu

Stocks MENU

- < View Bonds Menu

Bonds MENU

- < View Mutual Funds Menu

Mutual Funds MENU

- < View Global Investing Menu

Global Investing MENU

- < View Annuities Menu

Annuities MENU

- < View ETFs Menu

ETFs MENU

- < View Types of IRAs Menu

- Traditional IRA

- Roth IRA

- SEP IRA

- IRA Rollovers

- IRA CDs

Types of IRAs MENU

- < View Taxable Brokerage Accounts Menu

Taxable Brokerage Accounts MENU

- < View BrightFolio Menu

BrightFolio MENU

- < View Family Menu

Family MENU

- < View Retirement Menu

Retirement MENU

- < View Wealth Transfer & Inheritance Menu

Wealth Transfer & Inheritance MENU

- < View Work & Career Menu

Work & Career MENU

- < View Health & Wellness Menu

Health & Wellness MENU

- < View Women and Investing Menu

Women and Investing MENU

- < View Considerations for LGBT Menu

Considerations for LGBT MENU

- < View Philanthropy Menu

Philanthropy MENU

- < View Our Clients Menu

- Private Wealth Signature

- Private Wealth RESERVE

Our Clients MENU

- < View Goals-Based Planning Menu

- Goals-Based Planning Process

- SummitView

Goals-Based Planning MENU

- < View About Us Menu

- History, Vision and Mission

- Our Leadership

- Careers

About Us MENU

- < View Investment Solutions Menu

- Investment Philosophy

Investment Solutions MENU

- < View Banking Solutions Menu

- Deposits and Cash Management

- Credit and Lending

- Private Wealth Credit Cards

Banking Solutions MENU

- < View Retirement Solutions Menu

Retirement Solutions MENU

- < View Insurance Solutions Menu

- Personal Insurance

- Business Insurance

- Long Term Care Insurance

Insurance Solutions MENU

- < View Trust and Estate Solutions Menu

- Estate Settlement

- Personal and Charitable Trusts

- Insurance for Estate Planning

Trust and Estate Solutions MENU

- < View Truist PortfolioView Menu

Truist PortfolioView MENU

- < View Sports and Entertainment Menu

Sports and Entertainment MENU

- < View Medical Menu

Medical MENU

- < View Legal Menu

Legal MENU

- < View International Wealth Menu

International Wealth MENU

- < View Family Office Menu

Family Office MENU

- < View Leadership Menu

Leadership MENU

- < View How We Work Menu

How We Work MENU

- < View National Footprint Menu

National Footprint MENU

- < View Credit and Financing Menu

- Core Credit Solutions

- Asset Based Credit Solutions

- Equipment Financing

- Specialty Finance Solutions

Credit and Financing MENU

- < View Treasury Management Menu

- SunTrust SunView

- Online Information Control

- Receivables

- Payables

- Commercial Card Programs

- Checking and IOLTA

Treasury Management MENU

- < View Business Transition Menu

- Merger and Acquisition Advisory

- Business Transition Advisory

- Business Succession Advisory

Business Transition MENU

- < View Capital Markets Menu

Capital Markets MENU

- < View Commercial Real Estate Banking Menu

Commercial Real Estate Banking MENU

- < View International Solutions Menu

- Global Treasury Management

- Trade Services

- Trade Finance

International Solutions MENU

- < View Investment Banking Services Menu

Investment Banking Services MENU

- < View Escrow & Reinsurance Menu

- Specialized Escrow Solutions

- Reinsurance Collateral Trusts

Escrow & Reinsurance MENU

- < View Risk Management Menu

- Interest Rate Risk Management

- Key Person Insurance Solutions

Risk Management MENU

- < View Investment Banking Coverage Menu

Investment Banking Coverage MENU

- < View Senior Care Menu

Senior Care MENU

- < View Associations and Charities (NFP) Menu

Associations and Charities (NFP) MENU

- < View Auto Dealers Menu

- Dealer Financial Services

- Automotive Reinsurance

- Webcast Series for Auto Dealers

- Truist Dealer Insider

Auto Dealers MENU

- < View Commercial Real Estate Menu

Commercial Real Estate MENU

- < View Education Menu

Education MENU

- < View Food and Agribusiness Menu

Food and Agribusiness MENU

- < View Foundations and Endowments Menu

- Deep Not-for-Profit Expertise

- Proactive Strategic Collaboration

- Investment Advisory

Foundations and Endowments MENU

- < View Governments and Municipalities Menu

Governments and Municipalities MENU

- < View Healthcare Menu

- Healthcare Receivables

Healthcare MENU

- < View Logistics & Supply Chain Menu

Logistics & Supply Chain MENU

- < View Multi-Unit Retail Menu

- NAPA Loan Program

- McDonald’s Loan Program

Multi-Unit Retail MENU

- < View Plan & Budget Menu

- Budgeting

- Getting Organized

- Paying Bills

- ID Theft & Fraud Protection

- Taxes

Plan & Budget MENU

- < View Debt & Credit Menu

- Managing Credit

- Reducing Debt

- Borrowing Money

Debt & Credit MENU

- < View Family & Friends Menu

- Managing Money as a Couple

- Getting Married

- Starting a Family

- Teaching Kids About Money

- Aging Parents

- Friendships

Family & Friends MENU

- < View Work Life Menu

Work Life MENU

- < View Health & Wellness Menu

Health & Wellness MENU

- < View Travel Menu

Travel MENU

- < View Holiday Menu

Holiday MENU

- < View First Time Home Buyer Menu

First Time Home Buyer MENU

- < View Buying and Selling Menu

Buying and Selling MENU

- < View Renovating and Maintaining Menu

Renovating and Maintaining MENU

- < View Correspondent Lending Menu

Correspondent Lending MENU

- < View Realtor Builder Insights Menu

Realtor Builder Insights MENU

- < View Homeownership Calculators Menu

Homeownership Calculators MENU

- < View Retirement Menu

- Saving for Retirement

- Nearing Retirement

- Living in Retirement

Retirement MENU

- < View Protect Your Family Menu

- Insurance

- Estate Planning

Protect Your Family MENU

- < View Charitable Giving Menu

Charitable Giving MENU

- < View Market Insights Menu

- In the News

Market Insights MENU

- < View Financial Planning Menu

Financial Planning MENU

- < View Estate Planning Menu

Estate Planning MENU

- < View Health and Wellness Menu

Health and Wellness MENU

- < View Life Priorities Menu

Life Priorities MENU

- < View Sports and Entertainment Menu

Sports and Entertainment MENU

- < View Medical Professionals Menu

Medical Professionals MENU

- < View Legal Professionals Menu

Legal Professionals MENU

- < View Start Your Business Menu

Start Your Business MENU

- < View Control Cash Flow Menu

Control Cash Flow MENU

- < View Increase Profitability Menu

Increase Profitability MENU

- < View Grow Your Business Menu

Grow Your Business MENU

- < View Protect Your Assets Menu

Protect Your Assets MENU

- < View Transition Your Business Menu

Transition Your Business MENU

- < View Cash Flow Menu

Cash Flow MENU

- < View Financing and Capital Markets Menu

Financing and Capital Markets MENU

- < View Business Operations Menu

- Manage Employees

- Long Term Planning

- International Expansion

Business Operations MENU

- < View Fraud Protection Menu

Fraud Protection MENU

- < View Business Transition Menu

Business Transition MENU

- < View Industry and Local Trends Menu

Industry and Local Trends MENU

- < View Business Resilience Menu

Business Resilience MENU

- < View Investments Menu

Investments MENU

- < View Private Foundations Menu

Private Foundations MENU

- < View Associations Menu

Associations MENU

- < View Planned Giving Menu

Planned Giving MENU

- < View Endowments Menu

Endowments MENU

- < View Expert Interviews Menu

Expert Interviews MENU

- < View Trustees Menu

Trustees MENU

- < View forbes-image Menu

forbes-image MENU

- < View cookiegen Menu

cookiegen MENU

- < View transfer Menu

transfer MENU

- < View renew Menu

renew MENU

- < View repay Menu

repay MENU

- < View cookiegen Menu

cookiegen MENU

- < View contact Menu

contact MENU

- < View thank-you Menu

thank-you MENU

- < View contact Menu

contact MENU

- < View thank-you Menu

thank-you MENU

- < View contact Menu

contact MENU

- < View thank-you Menu

thank-you MENU

- < View contact Menu

contact MENU

- < View thank-you Menu

thank-you MENU

- < View results Menu

results MENU

- < View funds Menu

funds MENU

- < View guidelines Menu

guidelines MENU

- < View application-info Menu

application-info MENU

- < View contact Menu

contact MENU

- < View thank-you Menu

thank-you MENU

- < View Sign On Menu

Sign On MENU

- < View Default Menu

Default MENU

- < View Login Menu

Login MENU

- < View Index Menu

Index MENU

- < View Documents Menu

Documents MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View Login Menu

Login MENU

- < View referencematerials Menu

referencematerials MENU

- < View releaseinformation Menu

releaseinformation MENU

- < View toolsforsuccess Menu

toolsforsuccess MENU

- < View quicklinks Menu

quicklinks MENU

- < View Default Menu

Default MENU

- < View cookiegen Menu

cookiegen MENU

- < View Login Menu

Login MENU

- < View referencematerials Menu

referencematerials MENU

- < View reports Menu

reports MENU

- < View forms Menu

forms MENU

- < View quicklinks Menu

quicklinks MENU

- < View Default Menu

Default MENU

- < View Release Information Menu

Release Information MENU

- < View cookiegen Menu

cookiegen MENU

- < View Login Menu

Login MENU

- < View Intro Menu

Intro MENU

- < View Documents Menu

Documents MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View cookiegen Menu

cookiegen MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View cookiegen Menu

cookiegen MENU

- < View Login Menu

Login MENU

- < View Default Menu

Default MENU

- < View user_manuals Menu

- Login

- Default

- cookiegen

user_manuals MENU

- < View Onlineachcontrol Menu

- Default

- cookiegen

Onlineachcontrol MENU

- < View otm-tutorial Menu

otm-tutorial MENU

- < View Login Menu

Login MENU

- < View cookiegen Menu

cookiegen MENU

- < View Default Menu

Default MENU

- < View Login Menu

Login MENU

- < View reference-materials Menu

reference-materials MENU

- < View other-solutions Menu

other-solutions MENU

- < View training Menu

training MENU

- < View contact-us Menu

contact-us MENU

- < View Index Menu

Index MENU

- < View cookiegen Menu

cookiegen MENU

- < View token-information Menu

token-information MENU

- < View access Menu

access MENU

- < View planning-and-expertise Menu

planning-and-expertise MENU

- < View rewards Menu

rewards MENU

- < View community Menu

community MENU

- < View whats-a-heloc Menu

whats-a-heloc MENU

- < View spending-in-retirement Menu

spending-in-retirement MENU

- < View smart-strategies-for-charitable-donations Menu

smart-strategies-for-charitable-donations MENU

- < View simple-strategies-for-protecting-what-you-earned Menu

simple-strategies-for-protecting-what-you-earned MENU

- < View principles-of-financial-planning Menu

principles-of-financial-planning MENU

- < View meet-your-goals-with-a-financial-plan Menu

meet-your-goals-with-a-financial-plan MENU

- < View how-to-borrow-for-college Menu

how-to-borrow-for-college MENU

- < View how-much-home-can-you-afford Menu

how-much-home-can-you-afford MENU

- < View fresh-perspective-on-retirement-income Menu

fresh-perspective-on-retirement-income MENU

- < View differences-between-traditional-and-roth-iras Menu

differences-between-traditional-and-roth-iras MENU

- < View college-savings-calculator Menu

college-savings-calculator MENU

- < View article12 Menu

article12 MENU

- < View 5-times-to-consider-refinancing-your-mortgage Menu

5-times-to-consider-refinancing-your-mortgage MENU

- < View 4-homebuying-myths-debunked Menu

4-homebuying-myths-debunked MENU

- Personal Banking

- Credit Cards

- Loans

- Mortgages

-

Small Business

Banking

- Compare Business Checking

- Business CDs

- Business Money Market Account

- Business Online and Mobile

- SunView Treasury Manager

- Online Bill Pay

- Online Courier

Payroll

Loans

- Business Term Loans

- SBA Loans

- Equipment Financing

- Commercial Mortgage

- Lines of Credit

- SBA Working Capital Loan

Your Future

- Investing & Retirement

- Wealth Management

- Corporate & Commercial

-

Resource Center

Personal Finances Resource Center

- Plan & Budget

- Saving

- Debt & Credit

- Family & Friends

- College

- Work Life

- Health & Wellness

- Travel

- Holiday

Small Business Resource Center

Homeownership Resource Center

- First Time Home Buyer

- Buying and Selling

- Renovating and Maintaining

- Correspondent Lending

- Realtor Builder Insights

- Homeownership Calculators

Commercial & Corporate Resource Center

Tracking Transactions

When does money go in and out of my account?

From day to day, there’s a lot to keep track of with your account, like when electronic/ACH withdrawals are going to come out, and your deposits are going to come in.

This page is designed to help you learn about the ins and outs of tracking your transactions and account balances, including information on processing times and details, daily deposit cut-off times, balance explanations and more.

We've made it easy to understand when your deposits will post and be available to use.

When deposited funds are available depends on the type of deposit (check, cash, Direct Deposit, etc.) and when it is made. The following chart will help you understand the daily cut-off times for each deposit type, and when the funds will be available for withdrawal or to cover transactions presented during nightly processing. Keep in mind that nightly processing occurs on regular business days (e.g., no Saturdays, Sundays or holidays). So, deposits made on weekends and holidays do not go through nightly processing until the next business day. For example, if you make a deposit on Saturday, it will not be processed until Monday night.

Type of deposit |

Cut-off time for deposit to post that day |

When it's available to cover transactions presented during nightly processing |

When it's available for withdrawal and debit card purchases |

|---|---|---|---|

Cash Deposit through the Teller |

Varies |

Same business day |

Immediately |

Cash Deposit through the ATM |

9 p.m. ET (M–F) |

Same business day |

Immediately |

Zelle® Payment |

6 p.m. ET (M–F) |

Same business day |

Immediately |

Cash Deposit through the Night Depository |

7 a.m. ET (M–F) |

Same business day |

Available once processed by the branch teller |

Direct Deposit |

Post throughout the day |

Same business day |

Immediately |

Check Deposit through the Teller |

Varies |

Same business day |

Next day after it has been processed |

Check Deposit through the ATM |

9 p.m. ET (M–F) |

Same business day |

Next day after it has been processed |

Mobile Deposit |

9 p.m. ET (M–F) |

Same business day |

Next day after it has been processed |

1 Generally, check deposits received by the cut-off time on business days will be available the next day. In some circumstances, SunTrust does place holds on deposits, which delays when those funds will be available. We encourage you to monitor your account and available balance through Online Banking and Mobile Banking. Learn more about holds below.

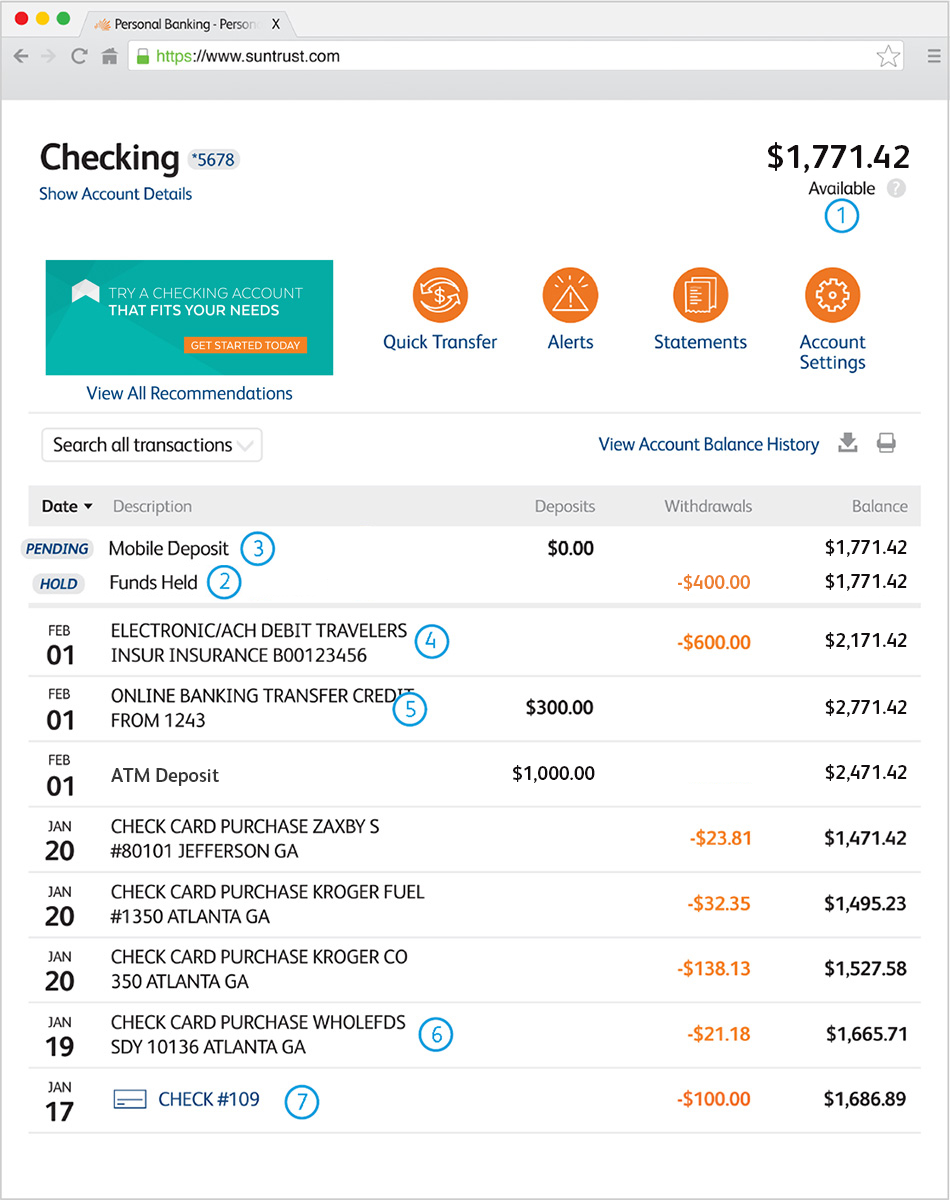

Check out the example of how various transactions are displayed within your account when you're logged in to Online Banking.

Then, find more details about each one in the list below.

-

1. Available Balance

-

Your available balance is the money currently in your checking or savings account for purchases, withdrawals, etc. It’s updated throughout the day with posted or pending transactions, like getting cash from an ATM and making debit card purchases.

The available balance reflects holds, but does not include checks that haven’t posted. It determines Overdraft Fees and Returned Item Fees.

Here's how your available balance is calculated:

In Online Banking, you can click the question mark next to your available balance to see exactly how your balance was calculated.

Keep in mind that your available balance differs from your current balance, which is the amount in your account after processing each night and does not change throughout the day. It does not include holds or pending transactions. For example, if you buy gas late at night with a debit card, the charge would not affect your current balance until the gas station processes your transaction and it posts to your account.

Your current balance is used to determine extended overdraft fees.

Finally, a third type of balance you might see is, your collected balance. It is the same as the current balance, except that it does not include any deposited checks for which we have yet to receive credit (the actual funds).

-

-

2. Hold

-

Generally, check deposits received by the cut-off time on business days are available the next day. But in some cases, we may place a hold on your account for a portion or full amount of a deposited check. If a hold is placed, those funds are not available to cover items during posting or for withdrawals and purchases until the hold expires.

There are a number of factors that contribute to a hold decision, including a review of account history and history of prior deposits. We encourage you to monitor your account and available balance through Online Banking and Mobile Banking. You can also sign up for email and text alerts in Online Banking to help manage your account activity.

If we place a hold on your deposit, we will notify you in one or more of these ways:

- Online and Mobile Banking

- Text Message (if you’ve enrolled in Online or Mobile Banking and have provided your mobile phone number)

- A detailed Notice of Hold (ATM receipt, email and/or letter via USPS

You will also be able to see the hold with this information in Online Banking, Mobile Banking and through our Automated Telephone Banking. You’ll be able to click on the transaction for details about when the funds will be available.

Learn more about Funds Availability and view our Funds Availability Policy for Deposit Accounts.

-

-

3. Pending Check Deposit

-

Check deposits display immediately after you make them so you can confirm we received them before they are posted and added to your balance. When you click on a pending deposit transaction, you’ll see that $0 is available now. That’s because the check has not yet posted, but we’ll confirm the deposit amount and explain when funds will be available (provided a hold is not placed).

-

-

4. Electronic/ACH Debit

-

Payments that come directly from your account are called electronic debits or ACH (Automated Clearing House) transactions. They are commonly used to make recurring payments like your car insurance, mortgage, gym membership or utility bills. Same for when you pay bills via Online Banking or Mobile Banking.

ACH/electronic debits will be deducted from your available balance as soon as we receive them for payment. They are not guaranteed—if you don't have a sufficient balance in your account or in an Overdraft Protection account, we may return or not pay the item and assess a Returned Item Fee. If we choose to pay the ACH/electronic debit on your behalf when your balance is not sufficient, we may assess an Overdraft Item Fee.

Note: By providing your checking account and routing numbers to a merchant, you are authorizing them to take ACH/electronic payments from your account according to your signed agreement. Once authorized, SunTrust cannot stop these transactions. You must contact the merchant. However, if your account is debited when authorization has not been given, you may dispute the transaction provided it meets certain criteria.

Visit our Additional Transaction Types page for more about Electronic/ACH transactions.

-

-

5. Transfer

-

There are a few different types of transfers that you can make:

- Internal transfers between your SunTrust accounts

- External transfers between your SunTrust account and your account at another bank, or to a third party

- Payments to almost any individual with a bank account in the U.S (Zelle®)2

- Wire transfers

The type of transfer you make determines when the funds will be available.

With Internal Transfers, you will have immediate access to funds.

With External Transfers, funds are available up to three days after the transfer.

With Zelle, money can be received typically in minutes.2

With Wire Transfers, funds are available once the transfer is processed.There are no charges for internal transfers between SunTrust accounts, for an incoming transfer from your account at another financial institution or for standard Zelle transactions. To see the fees that apply to other transfers, view our Fee Schedule.

Visit our Additional Transaction Types page to learn how to initiate these transfers.

-

-

6. Debit Card Transactions

-

Debit card transactions show up as pending before they post, or are considered final. This is because we won’t know the final amount until the merchant submits it to us for payment.

For transactions where a tip is included (i.e., restaurant), or an estimated authorization amount is run (i.e., hotel), the amount that posts may be more than when it was pending, because any tips or extra expenditures weren’t added to the transaction until the merchant submitted it.

In some cases, the posted amount may be less than the authorized amount from a hotel, car rental agency, etc., as they commonly include a refundable deposit in their authorization.

In any case, SunTrust does not determine the authorization amount—the merchant does. If you’d like details, ask the merchant how their authorizations work, or what the standard amount is. Generally, authorizations stay on your account for three days, and are removed if no follow up transaction posts.

Most merchants process transactions within three days, but can take five or more. If a merchant submits a final transaction for posting after the initial three-day time period, you are still responsible for the payment.

We provide as much information as we can about each debit card transaction in Online and Mobile Banking. When you click on a transaction, you’ll see the date and time of the transaction, the last four digits of the debit card number used, a merchant description and location. Pending transaction amounts that may be changed by the merchant before posting are also noted, such as an added tip or release of a hotel deposit.

Learn more on our Debit Card Transactions page.

-

-

7. Check Payment

-

A check is a request to pay a specific amount of money from your checking account to another person, merchant or organization. You can also write a check to withdraw cash from your own account. The timing of when a check impacts your balance is determined by when and how it is presented for payment.

- If you write a check to a person and it gets cashed at a SunTrust branch, we'll immediately lower your available balance

- When you write a check to a person or merchant and they deposit it into their account, your account balance will be reduced when the check is deposited and sent to us for processing

In any case, if your available balance is not sufficient to cover the transaction amount and you do not have an Overdraft Protection account set up with sufficient funds, we may choose to return, or not pay the check and assess a Returned Item Fee. If we choose to pay the check on your behalf, we may assess an Overdraft Item Fee.

Learn more about Overdraft Services and Overdraft Fees.

-

- Get to know when we post transactions See The Order

- Learn more about Funds Availability Read Policy

DISCLAIMERS

2 Must have a bank account in the U.S. to use Zelle®. Transactions between enrolled Zelle users typically occur in minutes. If your recipient is not yet enrolled with Zelle, it may take between 1 and 3 business days after they enroll. Transaction limitations apply.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Resource Center

-

Podcast: Depending on the honor of thieves

You never want to hear that your data has been breached. Today’s guest recently experienced a ransomware attack and walks us through how it felt, and how her company reacted.

-

Podcast: Cybersecurity is a business imperative

When it comes to fraudulent attempts on your business, human error is often the difference between a cybercrime that’s squashed and one that succeeds.

-

Podcast: Technology is a double-edged sword

The advance of technology has led to more damaging fraudulent attempts, with nearly half of companies experiencing an attack in the last two years.

-

Tech and Expertise Come Together at Truist

As we fully transition to Truist, we want you to know that our combination of innovative technology and personal expertise will maintain the client experience you’ve come to expect.

-

Developing Winning Partnerships in the Food Industry

As prices rise and consumer behaviors shift, food companies have an opportunity to work with supply chain partners to more effectively compete with larger players.

-

Contact

chat-personal-sales-English

About Us

Find Us

Truist Bank, Member FDIC. ©2022 Truist Financial Corporation. SunTrust®, the SunTrust logo, and Truist are service marks of Truist Financial Corporation.

Equal Housing Lender

Investment and Insurance Products:

- Are Not FDIC or any other Government Agency Insured

- Are Not Bank Guaranteed

- May Lose Value

All Truist mortgage professionals are registered on the Nationwide Mortgage Licensing System & Registry (NMLS), which promotes uniformity and transparency throughout the residential real estate industry. Search the NMLS Registry.Link opens a new window

Services provided by the following affiliates of Truist Financial Corporation: Banking products and services, including loans and deposit accounts, are provided by SunTrust Bank and Branch Banking and Trust Company, both now Truist Bank, Member FDIC. Trust and investment management services are provided by SunTrust Bank and Branch Banking and Trust Company, both now Truist Bank, and SunTrust Delaware Trust Company. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist Investment Services, Inc. (d/b/a SunTrust Investment Services, Inc.), and P.J. Robb Variable Corp., which are SEC registered broker-dealers, members FINRALink opens a new window, SIPCLink opens a new window, and a licensed insurance agency where applicable. Investment advisory services are offered by Truist Advisory Services, Inc. (d/b/a SunTrust Advisory Services, Inc.), GFO Advisory Services, LLC, BB&T Securities, LLC, Sterling Capital Management, LLC, and Precept Advisory Group, LLC, each SEC registered investment advisers. Sterling Capital Funds are advised by Sterling Capital Management, LLC. Mortgage products and services are offered through SunTrust Mortgage, a tradename for SunTrust Bank now Truist Bank. Life insurance products are offered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR license #100103477, a wholly owned subsidiary of Truist Insurance Holdings, Inc.

"Truist Advisors" may be officers and/or associated persons of the following affiliates of Truist Financial Corporation: SunTrust Bank now Truist Bank, our commercial bank, which provides banking, trust and asset management services; Truist Investment Services, Inc., a registered broker-dealer, which is a member of FINRALink opens a new window and SIPCLink opens a new window, and a licensed insurance agency, and which provides securities, annuities and life insurance products; Truist Advisory Services, Inc., an SEC registered investment adviser which provides Investment Advisory services.

Comments regarding tax implications are informational only. Truist and its representatives do not provide tax or legal advice. You should consult your individual tax or legal professional before taking any action that may have tax or legal consequences.

Truist Wealth, International Wealth, Center for Family Legacy, Business Owner Specialty Group, Sports and Entertainment Group, and Legal and Medical Specialty Groups are marketing names used by affiliates of Truist Financial Corporation.

Truist Securities is the trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries, including Truist Securities, Inc., member FINRALink opens a new window and SIPCLink opens a new window.

New York City residents: Translation or other language access services may be available. When calling our office regarding collection activity, if you speak a language other than English and need verbal translation services, be sure to inform the representative. A description and translation of commonly-used debt collection terms is available in multiple languages at www.nyc.gov/dca.

Thank you for choosing SunTrust now Truist. We welcome the opportunity to serve your financial needs. While SunTrust and BB&T have merged to become Truist, both institutions will continue to offer independent product lines for a period of time. This may include differing underwriting guidelines, product features, terms, fees, and pricing.

Our friendly teammates at your local BB&T branches will be happy to walk you through their products. You can also learn more by contacting them at 1-800-BANK-BBT or BBT.com.

-

SunTrust is now Truist. If you’re new to SunTrust, use Truist.com to see what’s new and to open accounts. That way you’ll be one step ahead when all SunTrust accounts move to Truist in 2022. If you already have SunTrust accounts, please keep using SunTrust.com to manage those accounts or to open new ones. You’ll have a better banking experience today, and a better transition to Truist in February 2022.